Is Now the Time to Buy “Activity Stocks?”

07 Dezembro 2020 - 8:18AM

Finscreener.org

A debate is opening in the Wall Street analyst community if it

is now the time to buy what they call “activity stocks” versus

“stay-at-home stocks?” Analysts broadly define activity stocks as

belonging to companies in the travel, entertainment, and

hospitality sectors. In contrast, stay-at-home stocks are related

to the technology sector, like Netflix (NASDAQ: NFLX)

and Amazon (NASDAQ:

AMZN).

The financial media is widely reporting that some significant

hedge funds are

rotating away from tech and into sectors that have been beaten

down by the COVID-19 crisis. There is no doubt that the tech sector

has done well in 2020 as the virus forces people to remain at home

watching films and shopping online - while other sectors such as

airlines suffer miserably with passenger volumes down 80-90%.

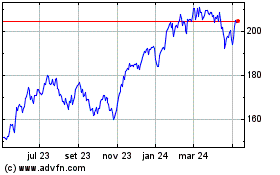

The chart below shows that the US tech sector is up nearly 34%

in 2020 - based on the Technology Select Sector SPDR Fund (AMEX:

XLK). In contrast, other sectors such as financial services -

based on the Financial Select Sector SPDR Fund (AMEX:

XLF) - are down more than 7% this year. Investors are divided

on whether tech stocks are overvalued while banks are hurting

because of low interest rates and rising loan loss provisions.

Is a Vaccine a Game Changer?

Fueling the rotation out of tech are expectations that the world

is on the brink of discovering a vaccine that could work to get

COVID-19 under control – allowing people to get out and start doing

things again. Press reports currently suggest three possible

vaccine candidates with an efficacy rate greater than 90% - making

“herd immunity” a real possibility depending on widespread uptake.

Progress on a cure is putting some optimism into the travel,

entertainment, and hospitality sectors.

A more challenging question to answer, however, is if life will

go back to “normal.” Few can agree if enough people will rush to

Disney Land to warrant investment into travel and leisure stocks in

2021. Some suggest it could be a long road back to get people

traveling the same way they did before the pandemic. For example,

airlines make a lot of money on business travel, and it is too

early to know if this form of meeting will bounce back as before or

if more cost-effective online conferences are here to stay.

An equally important question is whether it is time to pull the

plug on tech and invest in something else in 2021. Yes, tech has

had a good run in 2020, but that does not automatically mean that

investors should bail on these names if pandemic pressure ease. The

path out of this crisis remains unclear, and some consumer

behavior, such as an even more significant amount of online

shopping, may be here to stay even after COVID-19.

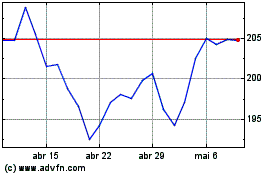

Technology Select Sector (AMEX:XLK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Technology Select Sector (AMEX:XLK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024

Notícias em tempo-real sobre Technology Select Sector da American Stock Exchange bolsa de valores: 0 artigos recentes

Mais Notícias de Technology Select Sector